tax credit survey social security number

Well as long as its reputable company yes it should be fine. Form 5227- filed by split interest trusts.

Asking For Social Security Numbers On Job Applications Goodhire

Is there a reason why they need our social security numbers.

. If they use the payment options on the IRS web site Direct Pay or Pay By CreditDebit Card would the estimated tax payments be entered using only the wifes social security number since it relates to her job income. This is strictly for tax purposes only and is the only time when it is acceptable to provide a research company with your social security number. TINs are a 9-digit number beginning with the number 9 and formatted like an SSN.

For more information about the Social Security number rules for the EITC see Rule 2 in Publication 596 Earned Income Credit. If you have any technical issues while completing the survey you can easily return to the Tax Credit Check page and re-initiate the survey at any point. Citizens and those with lawful alien status.

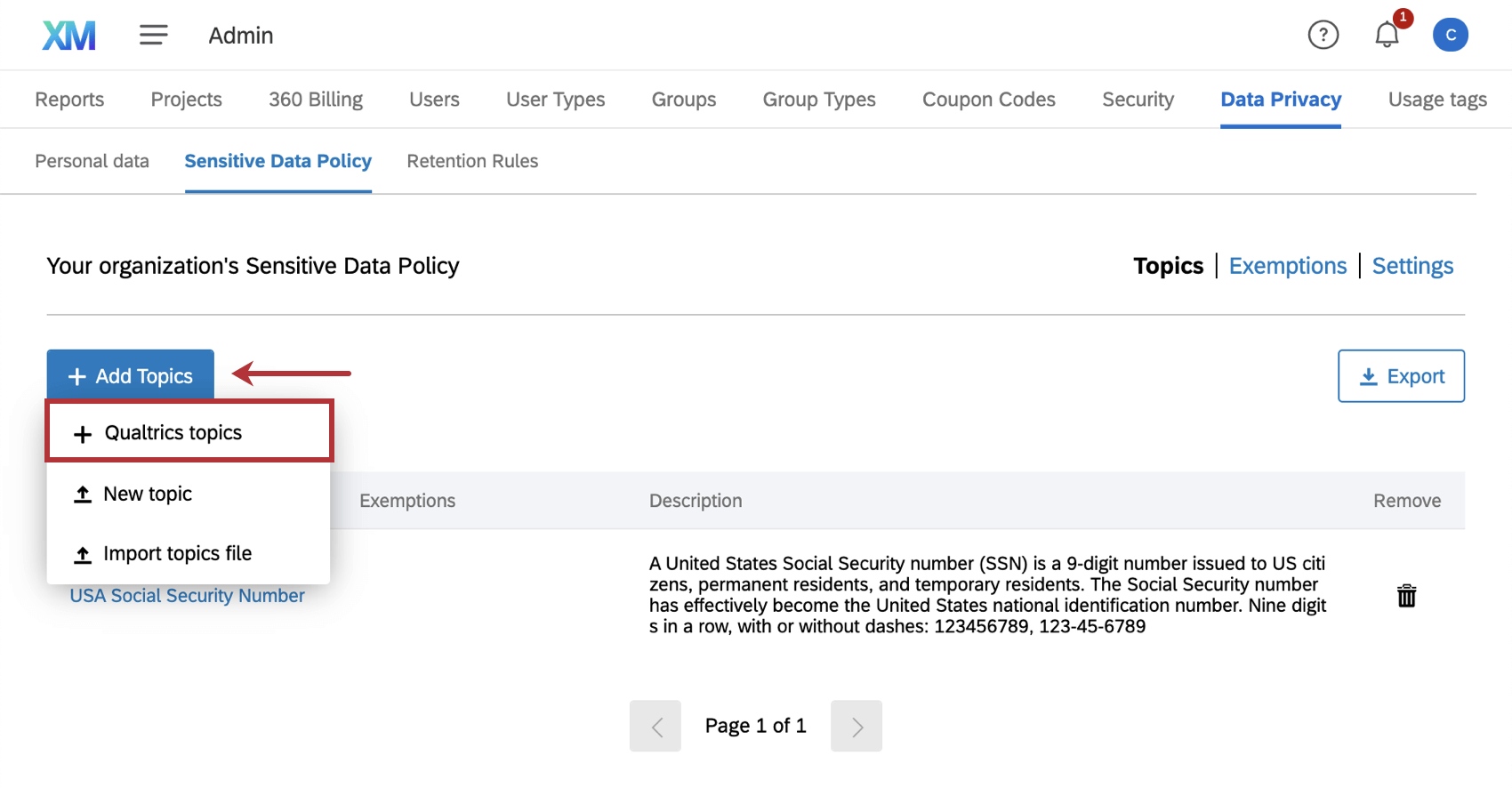

A WOTC tax credit survey includes WOTC screening questions to see if hiring a specific individual qualifies you for the credit. The answers are not supposed to give preference to applicants. Social Security Number Current Phone Number and Address.

Read our full guide on W9s and online survey taking if youd like to learn more. What is tax credit screening. Your health insurance company is required to provide Form 1095-B PDF Health Coverage to you and to the Internal Revenue.

So I guess I made a bad first impression on the phone. Tax credit screening questionnaire helps in providing more. If it asks for both should the wifes be listed first then the husbands the tax return shows the.

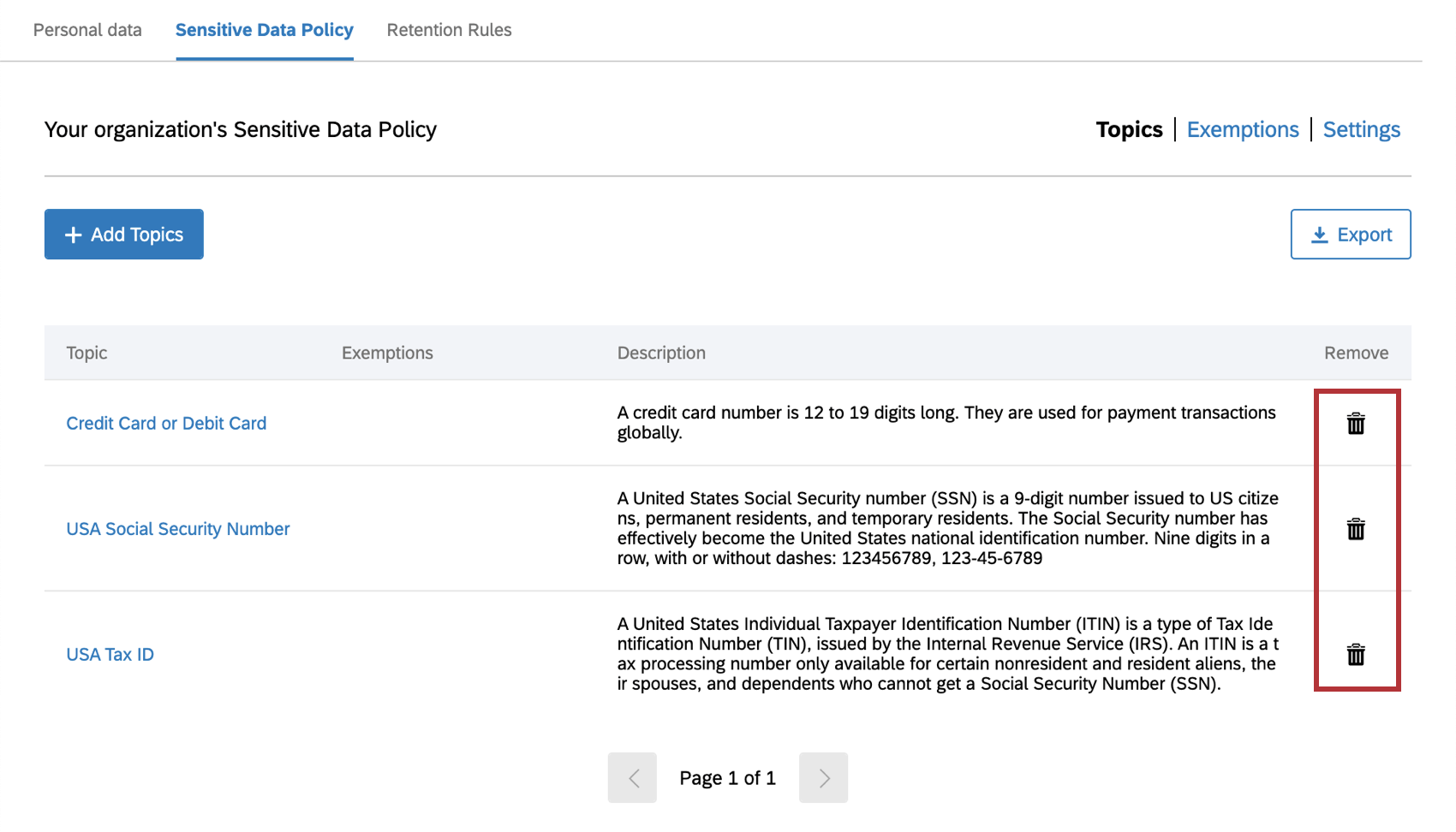

Here are the forms that should not include social security numbers. Its called WOTC work opportunity tax credits. Tax credit questionnaire ssn.

SSNs are issued to US. Make sure this is a legitimate company before just giving out your ssn though. Some companies get tax credits for hiring people that others wouldnt.

It asks for your ssn and if you are under 40. Big companies want the tax credit and it might be a determining factor in selecting one applicant. Since the survey displays in the current browser window you should not have browser security issues such as pop-up blockers and third-party cookie alerts.

So if it doesnt work out next time I know. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our websites chat box this one from a new hire. The amount of the tax credit available under the WOTC program varies based on the employees target group total hours worked and.

You have every right to be protective of your SSN though. Form 990T filed by charities. They will not begin with the number 9 The three major credit bureaus only use.

A taxpayer should continue to use their social security number to pay their estimated taxes once it has been issued even if it is not valid for employment or no longer valid for employment. Forms 8871 and 8872 filed by. As of 2020 the tax credit can save employers up to 9600 per employee with no limit on the number of employees hired from targeted groups.

Make sure this is a legitimate company before just giving out your SSN though. Forms 1023 and 1024 applications to the IRS for tax-exempt status. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction.

How To Get A Credit Card Without A Social Security Number Credit Cards Us News. Madhatters4 9K opinions shared on Other topic. All groups and messages.

Social Security offers three options to verify Social Security numbers. However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. The form will ask you for your personally identifiable information full name address etc as well as your SSN.

Forms 990 990EZ 990N-and 990PF the annual returns for charities and private Foundations. A WOTC tax credit survey includes WOTC screening questions to see if hiring a specific individual qualifies you for the credit. Find answers to Do you have to fill out Work Opportunity Tax Credit program by ADP.

You can possibly claim a credit equally to 26 percent of an employees pay if they work 400 hours or more during the tax year. Street Address 1 Street Address 2. Felons at risk youth seniors etc.

City State Zip Code County Parish. Forbes cites a survey of parents from the week before the first round of the expanded Child Tax Credit began in July which found that only 75 of immigrant parents were aware of the credit. Location Please upload a picture of your drivers license.

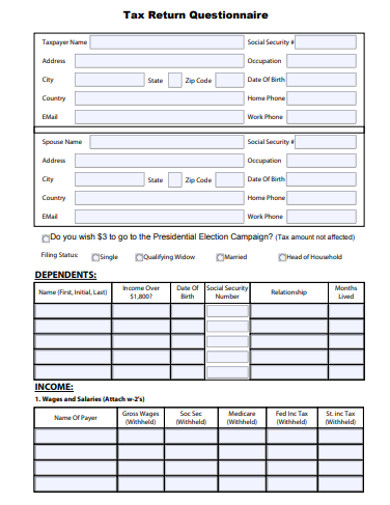

Once you are issued an SSN use it when paying your estimated taxes. My health insurance company has requested that I provide them with my social security number and the social security numbers of my spouse and children. The forms require your identifying information Social Security Number to confirm who you are and they ask for your date of birth because some of the target groups are.

You can possibly claim a credit equally to 26 percent of an employees pay if they work 400 hours or more during the tax year. The Social Security Number Verification Service - This free online service allows registered users to verify that the names and Social Security numbers of. Employers organizations or third-party submitters can verify Social Security numbers for wage reporting purposes only.

Rule 2You Must Have a Valid Social Security Number SSN To claim the EIC you and your spouse if filing a joint return must have a valid SSN issued by the Social Security Administration SSA by the due date of.

Canadian Tax News And Covid 19 Updates Archive

Inflation Already Impacting American Buying Behavior Credit Card Usage Forbes Advisor

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Us Covid 19 Bookkeeping Your Payroll Tax Credits And Deferrals Help Center

Covid 19 Has Transformed The Welfare State Which Changes Will Endure The Economist

Point In Time Connection City Of Hamilton Ontario Canada

Work Opportunity Tax Credit What Is Wotc Adp

Statement On Gender Diversity And Quality Of Life Budget 2022

Pin On Things That Should Make You Go Hmmm

12 Tax Return Questionnaire Templates In Pdf Ms Word Free Premium Templates

Work Opportunity Tax Credit What Is Wotc Adp

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

Netfile Access Code Nac 2022 Turbotax Canada Tips

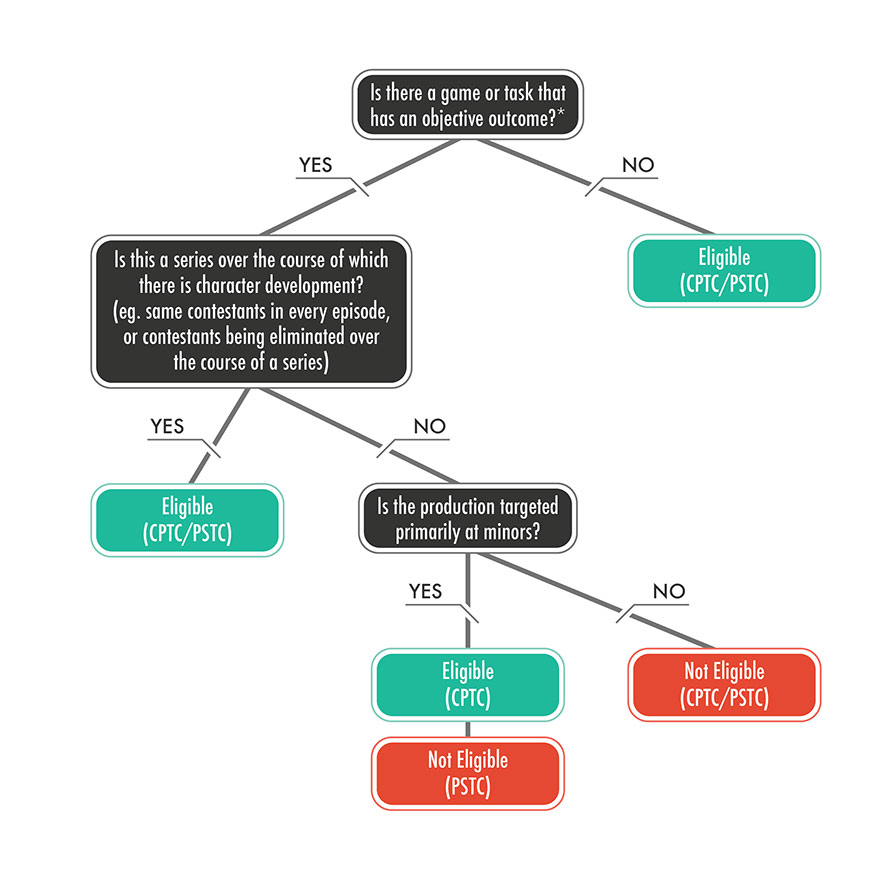

Application Guidelines Canadian Film Or Video Production Tax Credit Cptc Canada Ca

Review Of The Social Security Tribunal Of Canada Canada Ca

Credit Application Form 14 Free Word Document Customer Satisfaction Survey Template Engineering Resume Templates